Source: http://online.wsj.com/article/SB123353276749137485.html

By HAROLD L. COLE and LEE E. OHANIAN

The New Deal is widely perceived to have ended the Great Depression, and this has led many to support a "new" New Deal to address the current crisis. But the facts do not support the perception that FDR's policies shortened the Depression, or that similar policies will pull our nation out of its current economic downturn.

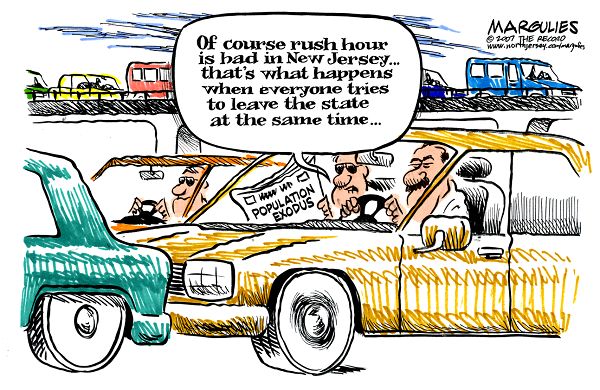

The goal of the New Deal was to get Americans back to work. But the New Deal didn't restore employment. In fact, there was even less work on average during the New Deal than before FDR took office. Total hours worked per adult, including government employees, were 18% below their 1929 level between 1930-32, but were 23% lower on average during the New Deal (1933-39). Private hours worked were even lower after FDR took office, averaging 27% below their 1929 level, compared to 18% lower between in 1930-32.

Even comparing hours worked at the end of 1930s to those at the beginning of FDR's presidency doesn't paint a picture of recovery. Total hours worked per adult in 1939 remained about 21% below their 1929 level, compared to a decline of 27% in 1933. And it wasn't just work that remained scarce during the New Deal. Per capita consumption did not recover at all, remaining 25% below its trend level throughout the New Deal, and per-capita nonresidential investment averaged about 60% below trend. The Great Depression clearly continued long after FDR took office.

Why wasn't the Depression followed by a vigorous recovery, like every other cycle? It should have been. The economic fundamentals that drive all expansions were very favorable during the New Deal. Productivity grew very rapidly after 1933, the price level was stable, real interest rates were low, and liquidity was plentiful. We have calculated on the basis of just productivity growth that employment and investment should have been back to normal levels by 1936. Similarly, Nobel Laureate Robert Lucas and Leonard Rapping calculated on the basis of just expansionary Federal Reserve policy that the economy should have been back to normal by 1935.

So what stopped a blockbuster recovery from ever starting? The New Deal. Some New Deal policies certainly benefited the economy by establishing a basic social safety net through Social Security and unemployment benefits, and by stabilizing the financial system through deposit insurance and the Securities Exchange Commission. But others violated the most basic economic principles by suppressing competition, and setting prices and wages in many sectors well above their normal levels. All told, these antimarket policies choked off powerful recovery forces that would have plausibly returned the economy back to trend by the mid-1930s.

The most damaging policies were those at the heart of the recovery plan, including The National Industrial Recovery Act (NIRA), which tossed aside the nation's antitrust acts and permitted industries to collusively raise prices provided that they shared their newfound monopoly rents with workers by substantially raising wages well above underlying productivity growth. The NIRA covered over 500 industries, ranging from autos and steel, to ladies hosiery and poultry production. Each industry created a code of "fair competition" which spelled out what producers could and could not do, and which were designed to eliminate "excessive competition" that FDR believed to be the source of the Depression.

These codes distorted the economy by artificially raising wages and prices, restricting output, and reducing productive capacity by placing quotas on industry investment in new plants and equipment. Following government approval of each industry code, industry prices and wages increased substantially, while prices and wages in sectors that weren't covered by the NIRA, such as agriculture, did not. We have calculated that manufacturing wages were as much as 25% above the level that would have prevailed without the New Deal. And while the artificially high wages created by the NIRA benefited the few that were fortunate to have a job in those industries, they significantly depressed production and employment, as the growth in wage costs far exceeded productivity growth.

These policies continued even after the NIRA was declared unconstitutional in 1935. There was no antitrust activity after the NIRA, despite overwhelming FTC evidence of price-fixing and production limits in many industries, and the National Labor Relations Act of 1935 gave unions substantial collective-bargaining power. While not permitted under federal law, the sit-down strike, in which workers were occupied factories and shut down production, was tolerated by governors in a number of states and was used with great success against major employers, including General Motors in 1937.

The downturn of 1937-38 was preceded by large wage hikes that pushed wages well above their NIRA levels, following the Supreme Court's 1937 decision that upheld the constitutionality of the National Labor Relations Act. These wage hikes led to further job loss, particularly in manufacturing. The "recession in a depression" thus was not the result of a reversal of New Deal policies, as argued by some, but rather a deepening of New Deal polices that raised wages even further above their competitive levels, and which further prevented the normal forces of supply and demand from restoring full employment. Our research indicates that New Deal labor and industrial policies prolonged the Depression by seven years.

By the late 1930s, New Deal policies did begin to reverse, which coincided with the beginning of the recovery. In a 1938 speech, FDR acknowledged that the American economy had become a "concealed cartel system like Europe," which led the Justice Department to reinitiate antitrust prosecution. And union bargaining power was significantly reduced, first by the Supreme Court's ruling that the sit-down strike was illegal, and further reduced during World War II by the National War Labor Board (NWLB), in which large union wage settlements were limited by the NWLB to cost-of-living increases. The wartime economic boom reflected not only the enormous resource drain of military spending, but also the erosion of New Deal labor and industrial policies.

By 1947, through a combination of NWLB wage restrictions and rapid productivity growth, we have calculated that the large gap between manufacturing wages and productivity that emerged during the New Deal had nearly been eliminated. And since that time, wages have never approached the severely distorted levels that prevailed under the New Deal, nor has the country suffered from such abysmally low employment.

The main lesson we have learned from the New Deal is that wholesale government intervention can -- and does -- deliver the most unintended of consequences. This was true in the 1930s, when artificially high wages and prices kept us depressed for more than a decade, it was true in the 1970s when price controls were used to combat inflation but just produced shortages. It is true today, when poorly designed regulation produced a banking system that took on too much risk.

President Barack Obama and Congress have a great opportunity to produce reforms that do return Americans to work, and that provide a foundation for sustained long-run economic growth and the opportunity for all Americans to succeed. These reforms should include very specific plans that update banking regulations and address a manufacturing sector in which several large industries -- including autos and steel -- are no longer internationally competitive. Tax reform that broadens rather than narrows the tax base and that increases incentives to work, save and invest is also needed. We must also confront an educational system that fails many of its constituents. A large fiscal stimulus plan that doesn't directly address the specific impediments that our economy faces is unlikely to achieve either the country's short-term or long-term goals.

Mr. Cole is professor of economics at the University of Pennsylvania. Mr. Ohanian is professor of economics and director of the Ettinger Family Program in Macroeconomic Research at UCLA.

No comments:

Post a Comment