Source: http://www.ibdeditorials.com/IBDArticles.aspx?id=323910687343049

By INVESTOR'S BUSINESS DAILY | Posted Monday, April 06, 2009 4:20 PM PT

Bailouts: Didn't Treasury Secretary Timothy Geithner say that it was not the administration's intent to control private companies? Then why is it reportedly reluctant to accept TARP repayments from some banks?

Read More: Business & Regulation

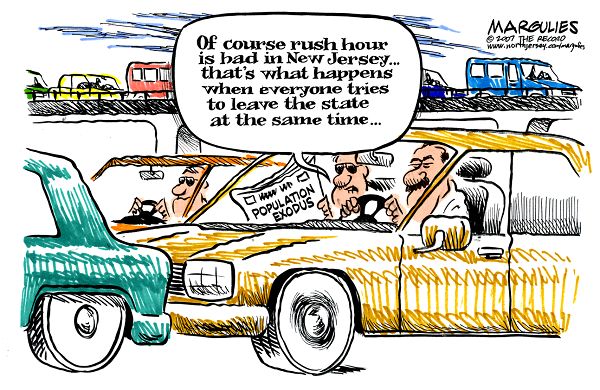

If it has indeed declined to accept $340 million in payments from banks in Louisiana, New York, Indiana and California, the administration is tacitly admitting that it wants to control those banks as well as others that will try to pay back the taxpayers' money they took in the Troubled Asset Relief Program.

By refusing repayment, the government can keep the leverage it bought with the bailouts. Banks that still "owe" would not be in position to reject the administration as a "partner."

This reminds us of mobsters making a small "investment" in a family-owned shop, which is not always wanted by the owners, and then using it to justify taking over the business.

Joseph DePaolo, president and CEO of Signature Bank in New York, one of the four banks making TARP repayments last week, said his company wanted to return $120 million it received because, in part, it wasn't comfortable with legislation passed that would limit compensation for salespeople. Those limits, he explained, would make it hard to recruit top professionals.

And then there's the fact that the bank didn't actually need the money. But, as we have learned, need is not relevant in the era of the bailout.

Andrew Napolitano reported last week on Fox News that he had spoken to the head of a $250-billion bank the night before who said Washington forced him to take TARP funds last September.

Napolitano said this bank "has no subprime loans, it has no bad debts, wasn't involved in credit default swaps. It didn't need any money. It didn't ask for the money and didn't want it. . . . officials from both the Federal Deposit Insurance Corporation and the Treasury said if you don't take this money, we will conduct a multi-year public audit of you."

The Fox News analyst said the bank's "board was forced to issue a class of stock just for the federal government. The federal government owns 2% of this huge bank."

That was done under the Bush administration. Enter the Obama White House. Last month, Napolitano said, Treasury told the bank "we own 2%, we're going to tell you how to run the place."

"As a result of that minority ownership, they now want to control salaries. They want to see his books, and they want to tell him who he can do business with," Napolitano reported.

Before his trip to Europe, President Obama, according to Politico, told a group of financial institution CEOs who were unhappy with the federal war on executive salaries and bonuses, "My administration is the only thing between you and the pitchforks." At the time, that sounded like nothing more than exaggeration.

An incident at the same meeting in which Geithner declined to take a fake $25 billion TARP repayment check from JPMorgan Chase CEO Jamie Dimon also seemed to be meaningful.

Later, says Politico, "Dimon also insisted that he'd like to give the government's TARP money back as soon as practical . . . But Obama didn't like that idea — arguing that the system still needs government capital."

Looking back, these are small signs that reveal the administration's desire to seize command of the nation's financial system. The bigger, unmistakable sign is the reluctance — or is it outright refusal? — to take $340 million from four banks trying to be responsible and operate on their own.

This shouldn't be happening in this country. The private sector and the state are not to be mixed. The American financial system is best directed by markets, not politics. Prosperity and liberty suffer when the latter excludes the former.

No comments:

Post a Comment