Source: http://www.ibdeditorials.com/IBDArticles.aspx?id=324687675703168

By INVESTOR'S BUSINESS DAILY | Posted Wednesday, April 15, 2009 4:20 PM PT

Banking: The bailout might have worked with a different administration and a different Congress. But it was poisoned by politics. Financial firms large and small have every reason to head for the exits.

Read More: Business & Regulation

We're writing here about the Troubled Asset Relief Program, known as TARP. But that's no typo in the headline above. The bankers whom TARP was supposed to help now are coming to see it as a snare and a delusion. The longer they stay, the more talent, autonomy and vitality their businesses will lose. Stay long enough and they might as well work at the DMV.

A half-dozen small banks have bailed from the bailout by raising private capital and paying back the capital infusions they had received from the Treasury.

Earlier this week, Goldman Sachs Group became the first of the big players to make its move for the exit. It said on Monday that it would buy back $10 billion in TARP capital, in part by offering $5 billion through an equity offering.

News of the stock issue knocked 9% off Goldman's market cap, leaving existing shareholders about $5 billion poorer.

Goldman's TARP escape was costly in another respect. The company's buying back its relatively cheap Treasury-owned shares, on which it pays a 5% dividend, while continuing to give Warren Buffett's Berkshire Hathaway a much sweeter deal. It pays Berkshire 10% dividends on $5 billion in preferred stock, plus warrants to buy $5 billion in stock at a strike price of $115 (with Goldman trading at about $120 Wednesday, those warrants were well in the money).

Once Goldman goes, the other strong banks will probably want to follow as soon as they can. The government might want to keep them from leaving, for good reasons (to help them get stronger) or bad (to put them under tighter control).

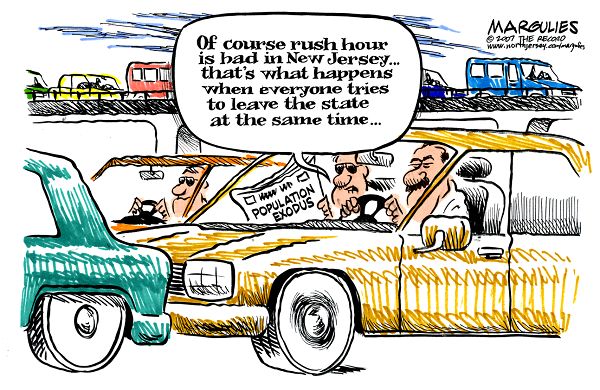

The leftists inside and outside the Obama administration will no doubt push for their preferred solution, outright nationalization. But the involuntary government takeover of sound banks is too close to outright dictatorship for the public to accept, as long as the public's instincts are still sound. So we expect the TARP exodus to continue and gather steam.

That would be good in the short term for taxpayers, who would get their investments back with interest. But the initial purpose of the TARP capital infusions was not to make a quick billion bucks. It was to bolster banks' capital for several years, if need be, so that they could return to normal lending. The object was to help the economy by strengthening the banks, not beating them into submission.

Obviously, Goldman and other banks fleeing TARP no longer see it as a source of strength.

What happened? One word: Politics.

Congress and the new administration could not resist the urge to stir up anti-bank populist rage. So the bankers were put on the hot seat at hearings. They were told they had to stop paying market-level bonuses to their best talent. They were told they were not lending enough, when lending too much is what got us into this mess.

Lately, they've heard mutterings from Congress that their fees and interest rates are too high. Elizabeth Warren, a Harvard law professor hired by Congress to head a panel overseeing TARP, is calling for "tough love" that might include firing of management at TARP-aided banks. She also suggests that taxpayers are "paying twice" through the bailout funds and increases in bank charges.

The left-wing organizing group Acorn is pressuring its Democratic allies in Congress to hold hearings on the banks' compliance with Barack Obama's "Making Home Affordable" foreclosure prevention plan.

Add all this up and you can see why bankers fear that the government wants to fire them and run their business. Given the logic of taxpayer aid — he who pays the piper calls the tune — this threat is clear and present as long as banks are on the federal dole. This is why they'll try to get out, even at a high cost to their shareholders.

A sound case can be made that the economy would be best served by a non-punitive TARP that gives the banks time and a long leash to restore their capital. If this were the TARP of today, then banks would not be leaving so soon, nor would it be the best course for them to do so.

But the program has morphed into something far different: Call it the TARP trap, poisoned by politics and no place where a rational banker would choose to be.

No comments:

Post a Comment